Augusta Precious Metals Review: Best Gold IRA ?

Looking for a Gold IRA you can truly trust?After reviewing all the top providers in the industry, my #1 recommendation is Augusta Precious Metals and here’s why: Augusta stands out for its unmatched transparency, customer-first approach, and exceptional service. They don’t use pressure tactics just honest, expert guidance to help you protect your retirement savings…

Looking for a Gold IRA you can truly trust?

After reviewing all the top providers in the industry, my #1 recommendation is Augusta Precious Metals and here’s why:

Augusta stands out for its unmatched transparency, customer-first approach, and exceptional service. They don’t use pressure tactics just honest, expert guidance to help you protect your retirement savings with physical gold and silver.

With thousands of 5-star reviews and top ratings from trusted sources like the BBB and BCA, Augusta has earned a reputation for doing things the right way and customers can feel it every step of the process.

If you’re serious about securing your financial future, Augusta Precious Metals is the gold IRA company to check out first.

Why More Retirees Are Turning to Gold ?

If you’re like many Americans nearing or enjoying retirement, you’re probably thinking a lot about how to protect your savings. After decades of hard work, the last thing you want is for market ups and downs or rising inflation to chip away at your financial security.

That’s why so many wise retirees are choosing to add physical gold and silver to their portfolios not for quick profits, but as a reliable way to preserve and protect what they’ve built.

Unlike paper dollars or stocks that can drop in value overnight, gold and silver have stood strong for generations. These are real, tangible assets things you can hold in your hand that don’t rely on Wall Street trends or political shifts.

If you’ve lived through a few market crashes, you already know how fast things can change. Gold and silver help add stability when everything else feels uncertain. Even during recent economic challenges and rising inflation, precious metals have continued to hold their ground.

And with a trusted name like Augusta Precious Metals, the process is simple and clear. Whether you’re considering a Gold IRA or just want to diversify with physical coins or bars, Augusta offers honest guidance and personal support from start to finish.

Because at this stage in life, it’s not just about growing your money it’s about protecting it, and making sure your future stays secure no matter what lies ahead.

✅ Why Augusta Precious Metals?

✅ A+ Rated by the Better Business Bureau (BBB) and Business Consumer Alliance (BCA)

✅ Backed by thousands of 5-star customer reviews across trusted platforms

✅ Offers a unique one-on-one web conference, created by their Harvard-trained economist, to help you understand the process clearly

✅ No high-pressure sales tactics just honest guidance and support

✅ Enjoy lifetime account service from a team dedicated to your long-term success

⚠️ Things to Consider

⚠️ $50,000 minimum investment

⚠️ Account setup isn’t fully online but the personalized support makes the process smooth

⚠️ Fees and storage options can vary always review the fine print

⚠️ Only offers gold and silver (no platinum or palladium)

⚠️ Always verify the company’s ratings and customer reviews

What Is Augusta Precious Metals?

Augusta Precious Metals is a leading provider of Gold and Silver IRAs, known for its transparency, customer education, and outstanding service. Based in Beverly Hills, California, Augusta has built a strong reputation among retirees and conservative investors who want to diversify their wealth with precious metals.

Founded in 2012, the company has consistently maintained A+ ratings with the Better Business Bureau (BBB) and AAA ratings with the Business Consumer Alliance (BCA). They also boast thousands of five-star reviews, especially from retirees who appreciate a no-pressure approach and expert guidance.

Why Choose Augusta Precious Metals?

1. Educational First Approach

One of the standout features of Augusta Precious Metals is their commitment to client education. Instead of hitting you with a hard sell, Augusta provides:

- Free one-on-one web conferences with their on-staff Harvard-trained economist

- In-depth videos explaining how Gold IRAs work

- Transparent breakdowns of risks and fees no fine print trickery

This approach is especially appealing to retirees who want to fully understand their options before committing. You’re never rushed or pushed into a decision which is rare in this industry.

2. Top-Tier Customer Service

Augusta doesn’t just open your Gold IRA and disappear. They provide lifetime support for your account, helping you with:

- IRA setup and funding

- Precious metals purchasing

- Required Minimum Distributions (RMD) guidance

- Ongoing market updates and portfolio monitoring

And best of all, you work with the same team throughout not a random call center or rotating sales reps. That kind of continuity builds real trust.

3. Unmatched Transparency

Many Gold IRA companies bury their fees or use confusing terms. Not Augusta. They’re upfront about:

- One-time setup fees

- Annual storage and custodial costs

- Shipping and insurance policies

4. Physical Gold Ownership

With Augusta Precious Metals, you’re not buying some paper certificate you’re buying real, tangible gold and silver. Your metals are stored in secure IRS-approved depositories, like the Delaware Depository or Brinks Global Services.

And yes, if the economy ever takes a hit, your gold is sitting in a vault not subject to stock market volatility.

Gold IRA: Get This Guide to Learn All About It.

Request the gold IRA guide to diversify and balance your retirement with gold.

How the Augusta Gold IRA Process Works

✅ Step 1: Free Consultation

You’ll start with a no-obligation web conference where Augusta walks you through the basics of precious metals investing tailored to your retirement goals.

✅ Step 2: Account Setup

Augusta helps you open a self-directed IRA through a trusted custodian like Equity Trust or GoldStar Trust. This process is 100% IRS-compliant.

✅ Step 3: Fund Your Account

You can roll over funds from your existing IRA, 401(k), 403(b), or TSP without triggering taxes or penalties.

✅ Step 4: Purchase Your Metals

Once your account is funded, Augusta helps you select the best mix of gold and silver based on your preferences and market trends.

✅ Step 5: Secure Storage

Your metals are shipped directly to an IRS-approved depository under your IRA’s name. They’re fully insured and stored in segregated accounts, meaning your gold is never mixed with anyone else’s.

Augusta Precious Metals Fees and Pricing

When it comes to protecting your retirement savings, you deserve transparency. Augusta Precious Metals makes it easy to understand what you’re paying for and why it matters.

Here’s a simple breakdown of the fees and costs involved:

✅ Minimum Purchase Requirement

To open a Gold IRA or make a direct purchase, you’ll need to start with $50,000 or more.

✅ One-Time Setup Fee

There’s a $50 application fee to get started. This covers your paperwork, account setup, and a helpful consultation to ensure a precious metals investment is the right fit for your goals.

✅ Annual Custodian Fees

In your first year, custodial fees are $250.

After that, it drops to just $100 per year.

These fees are for the IRA custodian who handles your account legally and securely.

✅ Secure Storage Fees

$100 per year, but Augusta covers this for you.

That means your gold is safely stored in a top-tier, IRS-approved depository at no extra cost.

✅ Free Shipping on Qualified Orders

If you meet the minimum, Augusta pays for the shipping and insurance of your precious metals during transit. That’s peace of mind delivered right to your door or your vault.

✅ Transparent Markup

When you buy bullion (gold and silver bars or coins), Augusta charges a modest 5% markup with no hidden fees or surprises.

Is Augusta Precious Metals Right for You?

If you’re a retired or soon-to-retire American who wants to protect your savings from inflation, stock market crashes, and global uncertainty, then yes Augusta Precious Metals is one of the best options available.

Augusta Precious Metals: The Gold Standard

⭐ Founded: 2012

⭐ Minimum: $50,000

⭐ BBB Rating: A+

⭐ BCA Rating: AAA

⭐ Customer Reviews: 5-star average (thousands of reviews)

Unique Features:

✅ One-on-one web conference with Harvard-trained economist

✅ Lifetime account support

✅ Transparent fees

✅ Zero sales pressure

✅ Physical gold/silver only

Who it’s best for:

Serious retirees looking for education, long-term service, and complete peace of mind.

Why Augusta Stands Out?

1. Best-in-Class Education

Only Augusta offers a Harvard-trained economist who personally walks you through how Gold IRAs work in a one-on-one web conference. No other competitor offers that level of personalized, academic insight. This is gold-level financial education literally.

2. No High-Pressure Sales

Many retirees report feeling pushed or manipulated by other Gold IRA companies. Augusta is different. Their no-pressure policy means you can ask every question, take your time, and invest only when you’re ready.

3. Highest Trust Ratings

With A+ ratings from the BBB, a AAA score from the BCA, and thousands of verified five-star reviews, Augusta has one of the strongest reputations in the industry built on honesty, clarity, and consistency.

4. Transparency You Can Count On

Augusta is one of the only companies that fully discloses all costs upfront:

- One-time account setup fee

- Annual storage and custodian fees

- No hidden costs, commissions, or surprise charges

That means you know exactly what you’re paying no sticker shock later on.

5. Lifetime Customer Support

Most companies walk away after the sale. Not Augusta. They offer lifetime account support with a dedicated team who knows your name, your history, and your retirement goals.

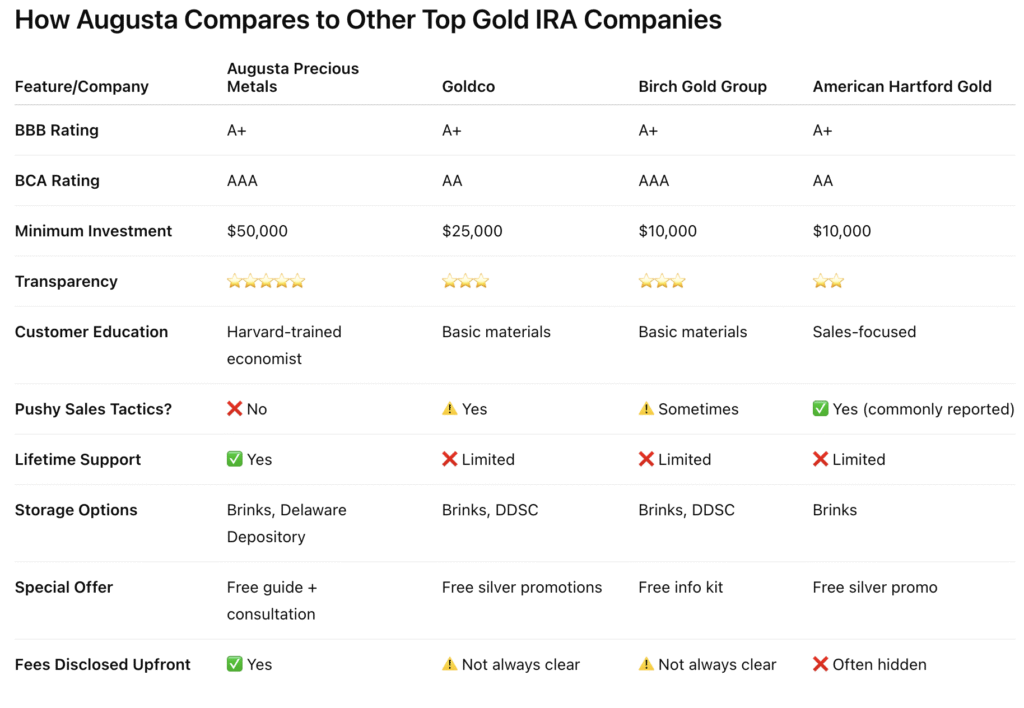

Where Competitors Fall Short

⚠️ Goldco

Goldco is popular and offers lots of promotions (like free silver), but their sales tactics are more aggressive, and several customers complain about unclear pricing. Their education is good, but not as personalized or in-depth as Augusta’s.

⚠️ Birch Gold Group

Birch offers a lower minimum and has solid ratings, but their customer service can be inconsistent. They’re a good budget option but may not provide the same level of ongoing support as Augusta.

⚠️ American Hartford Gold

Heavily advertised and endorsed by big media names, but reviews often cite pushy salespeople and vague pricing. While they do offer lower thresholds, they don’t provide the same trust or transparency.

Gold IRA: Get This Guide to Learn All About It.

Request the gold IRA guide to diversify and balance your retirement with gold.

Frequently Asked Questions

Q: How long does it take to receive my gold or silver?

A: Once your order is confirmed, it usually takes about 7 to 10 business days for your metals to arrive. Everything is handled with care, and your shipment is fully insured.

Q: What kinds of gold and silver can I buy from Augusta?

A: Augusta offers a nice variety from bullion coins and bars to premium gold and silver pieces. You can choose what fits your goals and comfort level best.

Q: Is my gold safe with Augusta?

A: Yes, your investment is in good hands. Augusta works with trusted storage partners and provides full insurance during shipping. While no system is perfect, Augusta has a strong reputation for putting clients’ safety first.

Q: Can I roll over my 401(k) into a Gold IRA?

A: Absolutely. Rolling over your 401(k) into a Gold IRA is penalty-free if done correctly and Augusta helps you handle all the paperwork from start to finish. They make it simple and stress-free.

Q: How much should I put into precious metals?

A: It depends on your personal financial situation, but many folks in retirement choose to put around 5–10% of their savings into gold and silver for peace of mind. It’s a good idea to talk with a trusted financial advisor to decide what’s best for you.

Q: Can I keep my gold at home?

A: You can, but it’s not the safest option. Home storage means risks like theft or fire. Augusta works with secure depositories like the Delaware Depository, and your metals are insured by Lloyd’s of London. It’s one less thing to worry about.

Q: How does Augusta compare to other companies?

A: Augusta stands out for its excellent customer service, clear fees, and educational resources. While other names like Goldco, American Hartford Gold, and Noble Gold are out there, many retirees find that Augusta offers a more personal, no-pressure experience.

Q: Who is Augusta Precious Metals really for?

A: If you’re over 50, concerned about inflation, and want to protect your retirement savings with real gold or silver, Augusta could be a great fit. Especially if you have $50,000 or more to start, want help with the paperwork, and value honest guidance, this company is worth a serious look.

Who Should Invest with Augusta Precious Metals?

If you’re retired or getting close and you’re starting to wonder how safe your money really is you’re not alone. Many folks are looking for smarter ways to protect what they’ve worked their whole lives to build.

That’s where Augusta Precious Metals comes in.

Here’s who this company may be a great fit for:

- 👉 You’re thinking about investing in gold or silver to add stability to your retirement savings.

- 👉 You’re interested in rolling over a portion of your IRA or 401(k) into something that holds its value over time.

- 👉 You have $50,000 or more set aside and want to protect it from inflation, market crashes, or future uncertainty.

- 👉 You’re tired of the ups and downs of the stock market and want a more tangible way to safeguard your wealth.

- 👉 You prefer a company that’s been around, has great customer reviews, and treats you like family not just a number.

- 👉 You’d feel better working with real, U.S.-based professionals not a high-pressure sales team.

If any of this sounds like you, Augusta Precious Metals might be worth a closer look. They’re known for educating their clients, not just selling to them and that’s exactly what most retirees are looking for today.

Gold IRA: Get This Guide to Learn All About It.

Request the gold IRA guide to diversify and balance your retirement with gold.